Purchasing Your Dream Home

The Home Buying Process

Buying a home is a big step!

Whether you're buying your first home, dream home, or tenth investment property, buying real estate is a major decision, and who you choose to work with is important. Working with the right agent ensures that you will find the perfect property for your unique circumstances – someone who takes the time to understand your goals, knows the market, loves real estate, and educates you throughout the buying experience.

Finding the perfect property is one part of your real estate purchase. It is equally important to team up with experts who can guide every element of the homebuying process, including lending, home inspection, appraisal, and sometimes, relocation.

Why Now is Still the Right Time to Buy a Home

In today’s high-interest environment, many potential homeowners may feel hesitant to take the leap—but this market offers unique opportunities that can work in your favor, especially when it comes to building equity and long-term financial benefits. Here’s why purchasing a home now could be one of the smartest decisions you make.

Key Benefits of Buying in a High-Interest Market:

01Lower Purchase Prices

Take advantage of less competition to find a home at a reduced price.

02Build Wealth Over Time

Start building equity now and enjoy appreciation as the market stabilizes.

03Refinancing Opportunities

Adjust your rate when conditions improve while keeping the equity you’ve built.

04Flexible Financing Options

Explore loan programs that work for you, including no-money-down options.

01Lower Home Prices, Bigger Equity Potential

With higher interest rates, the competition for homes has decreased, leading to lower home prices in many areas. This creates an incredible opportunity to purchase a property at a more affordable price. Over time, as interest rates normalize and home values appreciate, you can build significant equity, positioning yourself for excellent financial returns in the future.

02Refinancing Opportunities

Buying a home now locks in your ownership and begins your equity-building journey. Remember, you’re not locked into today’s interest rate forever—when rates drop, you’ll have the opportunity to refinance and lower your monthly payments. In the meantime, you’re investing in your future rather than paying rent.

03No Money Down Options

You might think you need a large down payment to buy a home in today’s market, but that’s not always true! Many loan programs, such as VA loans for veterans or USDA loans for eligible rural properties, allow qualified buyers to purchase a home with zero down payment. These options make homeownership accessible even in a high-interest market.

04Owning vs. Renting: Your Financial Advantage

Even in a higher interest rate environment, owning a home is an investment in your future. Rent payments offer no return on your money, but every mortgage payment contributes to your equity and builds wealth over time. Buying now gives you the advantage of ownership and a stake in the growing housing market.

Start Your Home Search

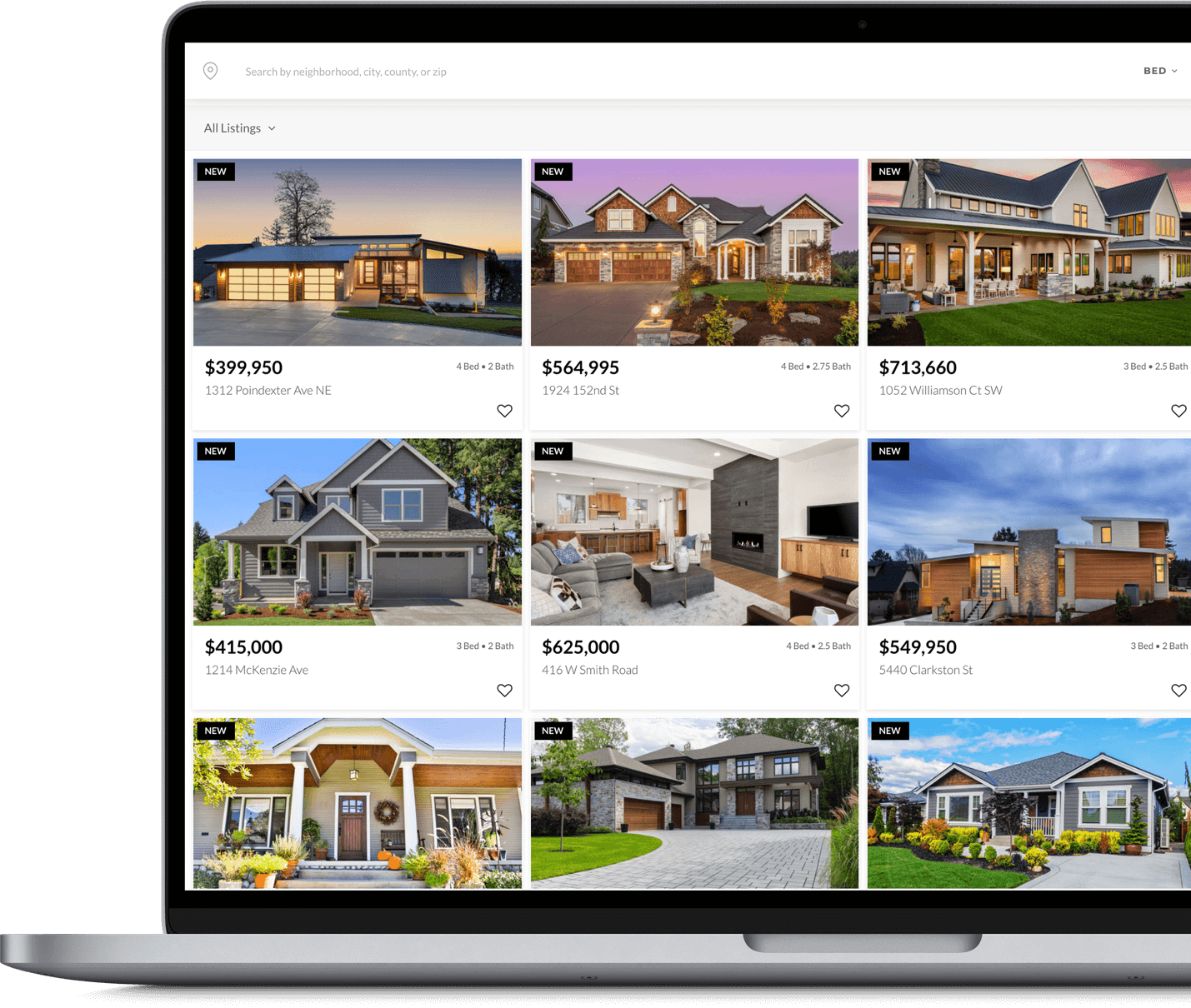

Search for homes anywhere, anytime

When you are ready to buy a home, start by making a wish list and setting a budget. Depending on your finances, you may need to choose a lender to get pre-approved for a loan so you can better understand your buying power. The pre-approval letter will also illustrate your financial readiness to sellers and make your offers more compelling.

You can search for the perfect property using this website on any device, including your desktop, laptop, tablet, or smartphone.

Start Searching

Sign Up for Listing Alerts

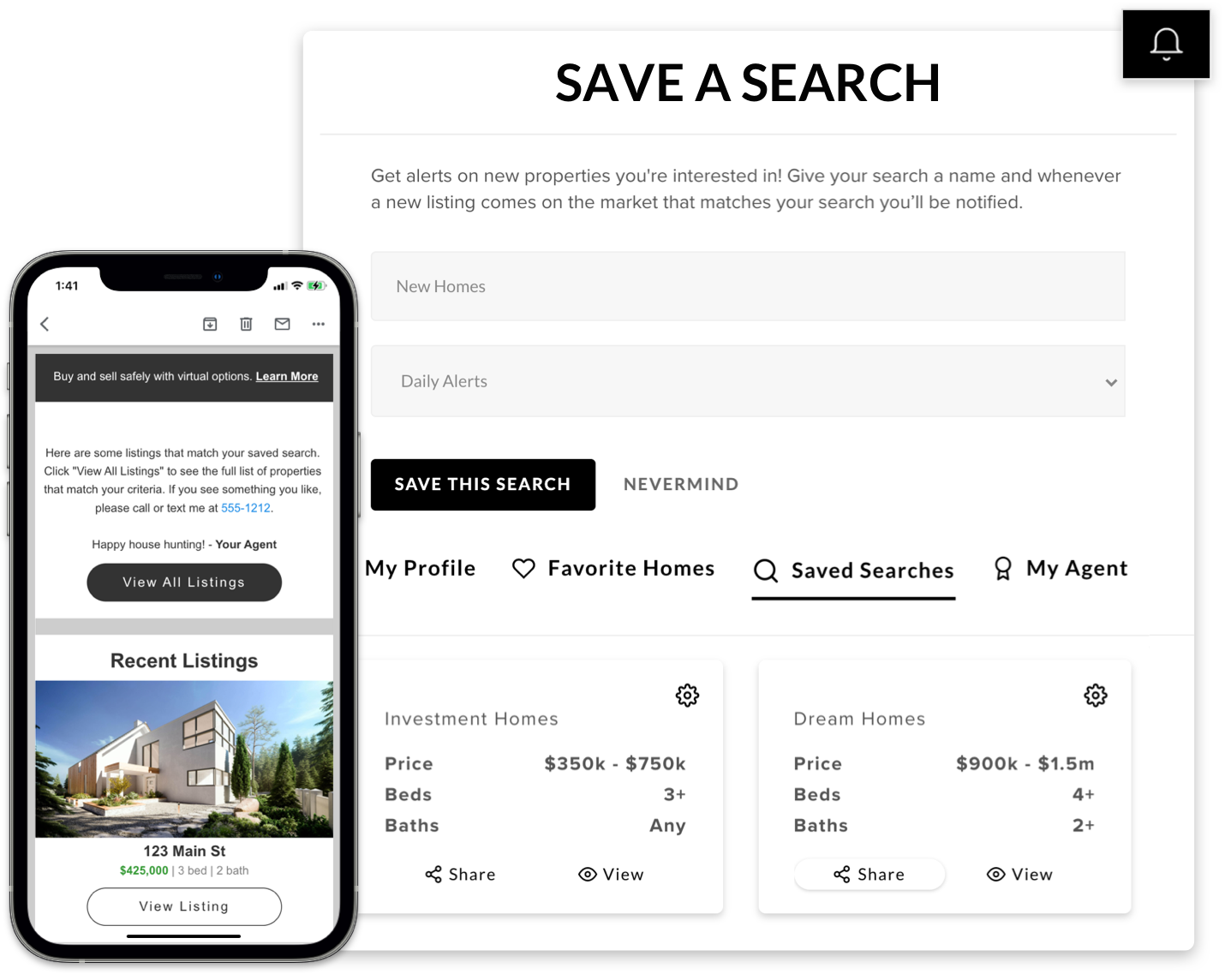

Be the first to know when a new property hits the market

Listing Alerts give you the edge over others looking to buy – once you register for Listing Alerts, an email is delivered straight to your inbox the moment a new property that matches your wish list criteria hits the market, enabling you to act fast.

Get Set Up

Save and See Listings

Favorite properties and tour homes

When you find a property you love, click the “ SAVE” button at the top left of the property details page. This will bookmark the property in your favorites section so you can easily view it whenever you visit this website. Favoriting listings also helps define which properties you are most interested in so that relevant Listing Alerts are both accurate and timely.

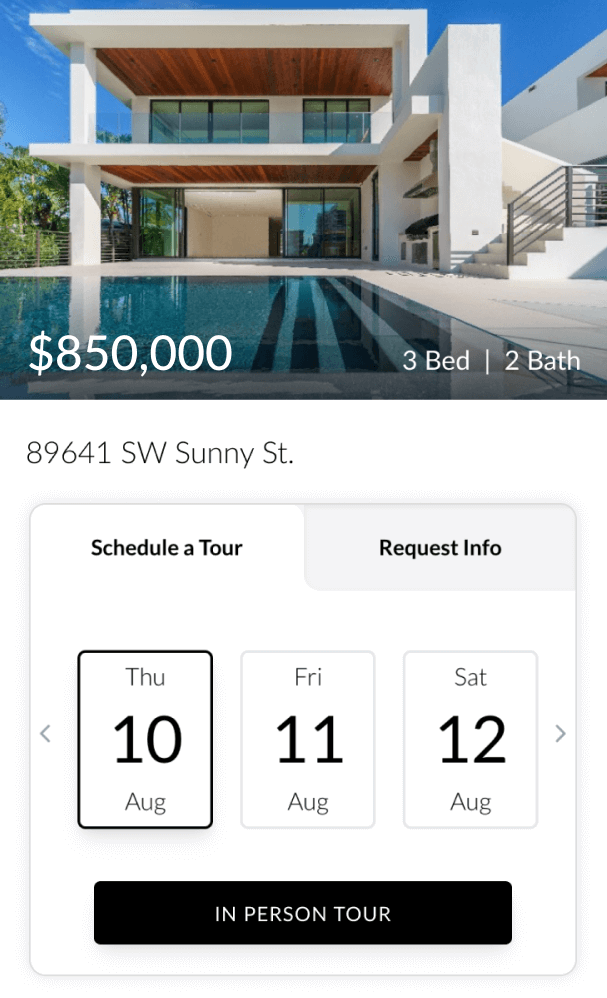

Click the "IN PERSON TOUR" button to schedule a showing online or call to set an appointment to visit the home, where you can ask any questions to help make a more informed decision.

Search Listings

Making An Offer And Closing

Partners Throughout the Home Buying Process

When you find a home you love, it’s time to submit an offer. Once your offer is submitted by your agent and accepted (typically after some negotiation), the next steps are moving through the inspection, appraisal, and closing processes in the most stress-free way possible. In addition to partnering with experts in each of these fields, having a knowledgeable agent to oversee the escrow process and ensure each deadline is being met on time is critical. You can rest assured that your agent is always acting in your best interest with a dedicated buyers agreement in place.

With the right support, each step of the homebuying process will feel seamless and easy so that you can focus on getting the keys, throwing a housewarming party, and making lasting memories in your new home!

Let's ConnectFrequently Asked Questions

Still have questions? Contact us today and let’s discuss your path to homeownership in today’s market!

Even with higher interest rates, purchasing a home now allows you to take advantage of lower home prices and less competition. As home values appreciate over time, you’ll build equity and can refinance later if rates drop.

By buying now, you begin building equity immediately. Over time, your home’s value is likely to increase, giving you a significant return on investment when you sell or refinance.

Yes! Loan programs like VA loans (for eligible veterans) and USDA loans (for rural properties) allow qualified buyers to purchase a home with zero down payment, making homeownership more accessible.

Waiting could mean missing out on today’s lower home prices. As the market stabilizes, prices may rise, making it harder to afford the home you want in the future.

You can explore adjustable-rate mortgages (ARMs), which often start with a lower interest rate, or take advantage of refinancing opportunities when interest rates decrease in the future.

Qualification depends on factors like income, location, and credit. Our team can help you determine if you qualify for programs like VA, USDA, or other low-down-payment options.

Renting provides no long-term financial benefits. Owning a home allows you to build equity, take advantage of tax benefits, and invest in your future, even in a high-interest market.

Yes! Many loan programs, like FHA and VA loans, are designed to assist buyers with lower credit scores. We’ll help you explore the best financing options for your situation.

Yes! With lower home prices and the potential for future appreciation, this market provides great opportunities for investors and buyers alike.

Our experienced team is here to guide you through every step of the homebuying process, from finding the perfect property to securing financing options that fit your needs. We’re dedicated to making your dream of homeownership a reality!